![]()

1980s

1982 · 19831984 · 1985

1986 · 1987

1988 · 1989

1990s

1990 · 19911992 · 1993

1994 · 1995

1996 · 1997

1998 · 1999

2000s

2000 · 20012002 · 2003

2004 · 2005

2006 · 2007

2008 · 2009

2010s

2010 · 20112012 · 2013

2014 · 2015

2016 · 2017

2018 · 2019

2020s

2020 · 20212022 · 2023

2024

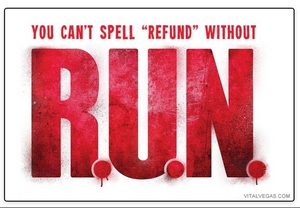

THE FINAL CURTAIN CALL? Cirque du Soleil would meet the new decade with high expectations and a myriad of projects on its slate, but like many, the company would see its dreams shatter as the world succumbed to its first real viral pandemic in over 100 years. The slow-motion shutdown of Cirque du Soleil should have been an early warning of the disaster to come. The novel coronavirus was still considered a local problem in late January, when Cirque du Soleil canceled performances of "X: The Land of Fantasy" in China. Within two months, the virus had spread to every corner of the world. "Everything was going very well," recalls Diane Quinn, Cirque's chief creative officer, who had visited the show in Hangzhou, near the epicenter of the outbreak in Wuhan, just a few weeks earlier... CORONAVIRUS CAUSES SHUTDOWNS "Right now, we all have the responsibility to step up, and to do preventive activities. We are going to keep leading in this effort by putting people's health and safety as our top priority", Daniel Lamarre said at the time. "We're going to continue to make sure that our partner Hangzhou Xintiandi Group who is managing the show, will put in place appropriate measures to further protect our audience members against the spread of the virus." The abrupt cancellation of "X: The Land of Fantasy" was a serious blow to profits, but a manageable one. Cirque still had 43 other shows around the world. COVID-19 would not have an official name for a few more weeks, and even as late as early March, the idea that it could grind the entire world to a halt seemed unimaginable. But then the Hong Kong leg of Amaluna's final tour had been canceled, with the show now closing on March 1st in Sacramento, California instead. Then, KOOZA's performances in Lyon, France were canceled and rescheduled, and performances of PARAMOUR in Hamburg, Germany were under restrictions in an attempt to curtail the spread of the disease there. Even One Night for One Drop, scheduled for March 24th, was postponed. "We are closely monitoring the rapidly evolving outbreak of [COVID-19] and will continue to work with global health officials, authorities and partners to determine what actions may be needed in the coming days or weeks," a spokesperson said. An outbreak in Italy was an inflection point for the company. Cirque had a show set to open in Rome (TOTEM) — its tent was already erected and tickets were being sold — when the event's promoter called it off. The show would have gone on to Milan, but that would clearly be impossible after the Italian government locked down the country on March 9th. One by one, the dominos fell — more cancellations, more travel restrictions, more bad news. "As the virus spread across Europe and ultimately into North America, we realized, boy, we're going to have a problem on our hands," Quinn said. Las Vegas, which accounted for some 35% of Cirque's revenue and is the company's most important market, was the final straw. On March 14th, CEO Daniel Lamarre received a call from MGM Entertainment in Las Vegas, informing him that all of the city's casinos and other tourist destinations would be shut down. "I woke up the day after, Sunday morning, and I had no more shows, no more revenue," Lamarre said. Safety is of utmost importance and our top priority. [...] Taking into consideration the World Health Organization (WHO) and the Center for Disease Control (CDC) recommendation for social distancing as well as the escalation of the Coronavirus (COVID-19) pandemic, following cancellations and/or postponements of numerous Cirque du Soleil shows in recent days, Cirque du Soleil Entertainment Group announced the immediate temporary suspension of all Cirque du Soleil shows world-wide. There were hopes in the early days that by limiting as many transmission vectors as possible, COVID-19 would quickly burn itself out. That proved not to be the case, however. The world had now come to a halt, and Cirque du Soleil with it. For the first time in 35 years, the show wouldn't go on. But with economies in free fall and no vaccine in sight, it remained to be seen how Cirque could reopen — and if it would be the same company when it did... TEETERING ON THE EDGE On March 16th, just three days after the immediate suspension of all its shows world-wide, Cirque du Soleil announced that it was laying off 95% of its workforce - a total of 4,679 employees - effective immediately. "This was an incredibly difficult decision, but a necessary measure to stabilize the company for the future," the company said in a press release. "It is the most difficult day in Cirque du Soleil Entertainment Group history. We're deeply saddened by the dramatic measures taken today, as the temporary layoff includes many hardworking, dedicated people. Unfortunately, this decision is our only option as we are forced to position ourselves to weather this storm and prepare for eventual re-openings," Daniel Lamarre said. Cirque du Soleil is working with all its partners, as well as the federal and provincial governments, to identify how to best support its employees and prepare for a healthy return as soon as the pandemic is controlled. Immediate steps to provide support for employees who have been laid off temporarily include paid vacation time, insurance coverage maintained during the temporary layoff and access to the Group's employee support program. These strategic actions will position Cirque du Soleil to continue operations and rebuild once the global crisis subsides. A core support team will continue working in the company to maintain basic operations, continue tour planning and ticket sales for our shows later this year and in 2021, and prepare for rehiring as soon as productions are allowed to resume. "As one of the most trusted brands and successful live entertainment organizations, we are confident that when the day comes when we can reopen our shows, we will be ready to welcome the millions of fans who come to our shows worldwide," concluded Lamarre. Immediately after, influential American bond credit rating company Moody's downgraded Cirque's credit rating deep into junk territory and said there was a "high risk" the company would default on its debt. Canceled shows were expected to result in steep financial losses for the company "with limited prospects for a tenable capital structure thereafter," the ratings firm said. A similar blurb on Yahoo Finance reported on S&P Global Ratings which "cut the company's rating to D, saying that it believed the company [would fail] to make principal and interest payments due March 31st on its first-lien credit facility and an interest payment on its second-lien facility." Lamarre responded that he had no other choice given that the company has had to cancel all 44 of its shows around the world. "It happened within a week ... we were shut down by cities and countries around the world," he said. "As we speak today, there is no revenue coming in for the company and I don't know when it will come back, which is why we're doing what we are doing. We have laid off most of our employees and we will keep just a small fraction of employees to be able, whenever the situation is stabilized, to come back in a short period of time." Of the 1,300 employees who worked at the head office in Montreal, 1,100 were laid off. Lamarre announced that 2,600 staffers and performers around the world were being sent home. Of the 240 employees still at work, 200 were at head office in Montreal, with another 40 still employed around the world, including 30 in Las Vegas. "I certainly hope (that the Cirque survives)," Lamarre said. "We are in communication with the government. I have been talking a lot with (Quebec Minister of Economy Pierre Fitzgibbon) ... I'm working on two fronts. On one hand, I'm working with the government to make sure that I can have some support ... and it's coming from Investissement Québec. They're the one that will help companies, so that's one front. The other front is we have the Caisse de dépôt, which is a very important shareholder and they're also very supportive of how they can help us." In hindsight, there were few companies as vulnerable to COVID-19 as Cirque du Soleil. Since its inception in 1984, it's played shows in 1,450 cities in 90 different countries, and large gatherings are their lifeblood. Its vast army of 1,800 artists relies on international travel to get from show to show, regularly crossing borders, performing on cruise ships, and interacting with fans. Daily training regimens require constant physical contact. The entire operation depends on an intricate logistical network of cargo ships, trucks, hotels, and food-service businesses, all of which had ground to a halt. In effect, government bans on large gatherings were a ban on Cirque itself, leaving a company that generated an estimated $950 million last year with essentially "zero revenues," according to Lamarre. IN COMBAT MODE The company was adamant that the massive layoffs were temporary, but just ten days later Reuters reported Cirque du Soleil was exploring restructuring options that included a potential bankruptcy filing, a course necessary to restructure its massive amount of debt. "Yes, we have liquidity problems. Yes, we are working to find solutions with our partners and the governments, but we are in combat mode," said Lamarre in an April 1st interview with La Presse. "We are not waiting for [a] miracle solution and we are not looking for subsidies to get by, we are working to put the company back on its feet so that it is ready as soon as the situation allows." Lamarre did not deny that bankruptcy was a possibility, though he called the reports "overstated." Cirque du Soleil had about $105 million in available funds, consisting of $20 million in cash and the rest from a revolving credit line, Moody's reported. But Cirque was now expected to spend about $165 million over the next year, including on ticket reimbursements for canceled shows and debt payments. It would need more income to stay afloat. Cirque had a wealthy patron in TPG Capital though, the private equity giant that purchased a majority stake in the company five years ago. Perhaps even more substantial, Lamarre said, was support from another major shareholder, Caisse de dépôt et placement du Québec, a Canadian manager of pension funds that doubled its stake in February. (The Caisse increased its share to 20% after buying the 10% stake still held by Cirque founder Guy Laliberté) "They're very eager to keep us alive," Lamarre said. Still, the relationship with TPG was complicated. The 2015 deal that made Cirque du Soleil co-founder Guy Laliberté a billionaire also saddled Cirque with nearly $900 million in leveraged debt, a type of loan given to companies that already have either a significant amount of debt already or a poor credit history. TPG Capital borrowed hundreds of millions to do it. That high-risk debt was later packaged into collateralized loan obligations and sold to global investors — a common practice among private equity firms to generate higher profits, but these high-risk leveraged loans make companies more vulnerable. Especially when the purchasing entity places the debt on the books of the company it purchased rather than on its own. Loans and interest were easily being paid off with shows raking in profits, and so Cirque du Soleil expanded, buying more companies like Blue Man Group, and borrowing more money. As debt increased, so did risk and the interest rates associated with them, which led them further into debt. Now, with that debt reduced to junk status, Cirque was forced into discussions on obtaining more funding. This lead to considering a $50 million loan from TPG, using its Canadian intellectual property rights as collateral to buy time while seeking government assistance. "Having support from the government would be helpful,” Lamarre said, referring to Cirque as a "Canadian ambassador" that represents the country all over the world. "It's kind of intriguing right now because we have no shows, we have no revenues, but we have an amazing brand." Between Caisse and TPG, and with an additional leg up from the government — Cirque's "three buddies," as Lamarre called them — the company looked to be in a better position than many entertainment and performing arts organizations, some of which had already announced permanent closure in the wake of the pandemic. But its debt load was only one part of the problem. CREATIVE CHALLENGES Even though Cirque du Soleil had confidently announced a number of new shows and projects for 2020 and beyond -- DRAWN TO LIFE to replace La Nouba at Walt Disney World; NYSA, a resident show in Berlin, Germany; R.U.N., a new action-oriented concept for Las Vegas, UNDER THE SAME SKY, a new touring production slated to debut in Montreal; plus a number of special events projects that had not yet been named -- the company was already severely struggling. Many consider the canceled 2019 IPO to be the first public indication that things were not going well. Further confirmation came in a December 2019 headline from the Montreal Gazette, which reported that Cirque du Soleil was about to lay off 53 creatives for productivity and reorganization purposes. But it was the early February 2020 blurb from the Globe and Mail announcing the Caisse de dépôt et placement du Québec had increased its share in Cirque du Soleil to 20% after buying the 10% stake still held by Cirque founder Guy Laliberté that wagged tongues and raised eyebrows. What did Guy know that the rest of us didn't? By then the February 27th announcement that Cirque was merging its multimedia creative studio (4UTC) with its recently renamed / consolidated events division (Cirque du Soleil Events + Experiences) to further reduce overhead barely registered. And that’s because word came that R.U.N, Cirque du Soleil’s new action-oriented project at Luxor Hotel and Casino in Las Vegas, was done. "We remain proud of the extraordinary talents that collaborated to make this one-of-a-kind live show happen, but ultimately it did not find an audience that could support it. Many avenues of creative options were explored to enhance the existing show, but the resources and time needed to make these changes proved to be obstacles too big to overcome. Creative risk is a part of everything we do at Cirque du Soleil. R.U.N was intended to push the boundaries of not only live entertainment, but of Cirque du Soleil’s own DNA, creating a unique form of entertainment that unfortunately did not receive the intended response. We’re grateful to those of you who saw and supported R.U.N and remain committed to bringing you ground-breaking live entertainment."

But R.U.N wasn't Cirque's only creative problem. According to Brendan Kelly of the Montreal Gazette, there were also serious creative problems plaguing "Under the Same Sky", the latest touring show concept hoping to have its world premiere under the big top in the Old Port of Montreal on April 23rd. (This, of course, before the pandemic shut everything down.) He reported that "Executives at Cirque du Soleil were not pleased after a preview performance at Cirque headquarters in St-Michel [recently]. This led to animated discussions between the executives and the show’s high-profile writer/director/production designer Es Devlin, who was not happy with the criticism. Cirque reps insist the London, England-based artist is still part of the show, but her role is now described as providing "conceptual support." Daniel Lamarre said Devlin — who has worked with Beyoncé, U2, Adele and Kanye West — will be given full credit for her work on the show. But he confirmed the Cirque has brought in a new director, Mukhtar O.S. Mukhtar, who has worked on previous Cirque shows, notably Messi 10. He will begin work on 'Under the Same Sky' in the coming days. Devlin is home resting in England, but will return to the show, according to Cirque officials." In either case, by April, with the world shut down, and all shows on standby, the Globe and Mail reported that Cirque hired the National Bank of Canada and U.S. investment bank Greenhill & Co. to advise its board of directors on either selling the company or negotiating a significant cash injection from its existing owners. The two investment banks then set a June 8th deadline for initial bids for the Cirque. And things we're about to get ugly. A BATTLE ROYALE BEGINS On Friday, May 1st, a lawyer representing Cirque du Soleil sent a formal notice to Québecor, a Canadian diversified media and telecommunications company, asking it to withdraw or correct information it published on one of its media platforms at the end of April. This document criticized the Journal de Montréal in particular for having published an article indicating that Cirque was controlled from a tax haven – "CDS Luxembourg Holdings" – which Cirque denied. Furthermore, the lawyer was adamant that this text was part of a campaign by Québecor aimed at harming the company and its shareholders in the hope of obtaining an "unfair advantage" in the company’s current proceedings, considering Québecor had twice demonstrated in the previous weeks, its interest in acquiring Cirque du Soleil. According to the formal notice, the "declared objective" was to "hinder [Cirque's] efforts in its efforts to obtain financial assistance or financing on market terms from the governments of Canada and Quebec in the context of the current crisis." Cirque said it had "serious reasons" to believe that Québecor, "through its media platforms, [was] currently seeking to undermine the process of maximizing Cirque's value for the benefit of its stakeholders, including its creditors, lenders and employees, and to exclude interested parties from participating in "the long-term solution" [described by Québecor], all in order to gain an unfair advantage from it." By 'unfair advantage', Cirque meant Québecor sought to thwart the company's recovery plans to acquire it at a better price. "There is reason to question Québecor's intentions, as its subsidiaries published no less than five articles on Cirque du Soleil in less than a week, which clearly [aimed] to disparage Cirque du Soleil and its sponsors." On May 4th, Québecor took off its gloves, and responded: The management of the Cirque du Soleil (the Cirque) has regrettably decided to make public the proposals it has received from Québecor, which had been sent in confidence to the various stakeholders, including numerous ranks of creditors and shareholders. This move comes at a time when the Cirque faces considerable uncertainty. Indeed, the company itself has raised the possibility of initiating proceedings to place itself under the protection of the Companies' Creditors Arrangement Act (C-36). Under the circumstances, Québecor has no choice but to publicly clarify its desire and determination to help save the Cirque, a creative powerhouse which is an economic engine for Montréal and all of Québec, and an ambassador for Québec talent on the international stage. { Read More of Québecor's Response Here } In the meantime, the Cirque received its emergency injection of US $50 million from its three main shareholders in an attempt to keep it afloat. Chairman Mitch Garber said each put in cash equal to their ownership percentages. That would mean TPG ponied up $27.5 million (55%), Fosun $12.5 million (25%) and the Caisse $10 million (20%). "The next phase is likely that the Cirque is going to be seeking additional capital," Garber said. "It could come in an offer to purchase the Cirque. It could come in the form of an offer to finance the Cirque, and I can confirm to you that the existing shareholders will be among those that want to continue to fund and own the Cirque du Soleil. I would say that everything is on the table (in terms of options), given the uncertainty and the length of time of the uncertainty." Garber also said the Cirque wouldn't allow Québecor executives to see the numbers because Québecor refused to sign a non-disclosure agreement. Garber had been very public in his criticism of Québecor CEO Pierre Karl Péladeau in the past, but sounded a conciliatory note here. "I think my personal feelings about Pierre Karl Péladeau are well known, and I shouldn't let them enter into a process where I owe a fiduciary duty of governance to a board of directors that has shareholders and creditors," Garber said. "So, to the extent that Québecor will be a fair player in any process that might come in the not-too-distant future, then I'm going to do my job and govern over that process and look at whatever anyone is going to offer, including Québecor. Of course, I won't appreciate the process being fought in the newspapers, but we'll cross that bridge when we come to it." But Québecor was not alone among potential Cirque suitors. Lamarre said there were other companies interested in buying Cirque that have signed confidentiality agreements. "There are other parties that are interested, big companies as well," he said. "So, right now we're going to go through the process to see all the options that we have ahead of us. … But unfortunately, the reason you're only hearing about Québecor is because they haven't signed yet the confidentiality agreement." Lamarre added, "They didn't sign it because I think they wanted to get some publicity before they do and that is their strategy, but all the others bidders that are interested that signed the NDA so therefore I cannot unveil their identity." But then... GUY LALIBERTÉ JUMPS IN In an opinion piece published in the Montreal Gazette on May 12th titled "Ensuring a bright future for Cirque du Soleil", Guy Laliberté himself weighed in on the battle... The paralysis of Cirque du Soleil's activities due to the pandemic has been making waves, and for me, has triggered a flood of emotions. Even though I'm no longer the company's owner, I will always be its founder; I have devoted half of my life to Cirque, and its success will always be close to my heart. As we head into a period that could be crucial for Cirque's future, I have decided to share my thoughts, driven by the desire to protect the Cirque family and to give back after having received so much, in the hope that these reflections will help ensure the best possible future for the company and its stakeholders. The audience's love for Cirque is the company's raison-d'être, and few true ambassadors of Quebec culture can pride themselves on shining as Cirque has done throughout the world. Two months after operations ground to a halt, as Cirque faces the biggest challenge of its existence, we're about to see a wrestling match involving a number of players. From my point of view, we're in for a battle royal: { Read More of Guy Laliberté Said Here } A few short weeks later, on the popular Radio-Canada talk show “Tout le monde en parle,” Laliberté announced he was going to jump in that ring. Laliberté stressed he was mounting a bid for Cirque because of his love of what the Cirque does and that money was not the main driving force behind his decision. "It's finding a perfect balance with a good healthy Cirque financially but also where the love of the public is coming back and mostly where the fire is within the workforce," Laliberté said. "It doesn't have to be US$1.5 billion of value to be viable. There will be a very difficult short term and focus on quality is what my focus is versus money. I will jump in if the price is right, but I don't want to be in an organization where money drives the future of Cirque. That would be very dangerous for the future of Cirque. ... I think there's a bright future for Cirque." Guy said he already had several major financial partners lined up to work with him on the bid, but did say it was not mounting the bid with TPG Capital. He also said it was too soon to say whether he would step back in as CEO of the company, or whether he would retain current management, including current CEO Daniel Lamarre. (There had been rumblings of displeasure with the current slate of executives from a number of sources.) "I won't tell you my recipe because everyone is keeping their plans to themselves," Laliberté said. "So I won't disclose my secret sauce. But I can tell you the love factor, the passion factor, the fire factor is what's always driven Cirque and I wanted to bring it back to where it once was. There's no right or wrong with what's been done with Cirque. Under my management we had highs and lows, but the Cirque is a living organism. It's very emotional and you need to understand it. Cirque feeds from its inner fire and you cannot buy that. Money can't buy the fire." But he admitted it would be tough to relaunch the Cirque. "Don't get me wrong, it'll be hell for the first two years and that's why I took time to reflect on this," Laliberté said. "Nothing is guaranteed, but I think we're the best team to make it happen. For sure it's a jungle out there. It's complex. But if I'm jumping in, it's a commitment of 10 to 15 years." And what would be even wilder than Guy Laliberté back at the helm? Why, Franco Dragone back as head of creation. "Guy called me two weeks ago, when he decided to jump into the field, to bring Cirque back to what it really is, to see if I was willing to jump with him," Dragone said. "I said yes. I have been approached by other people over the past month about Cirque, but I think Guy is the one I trust who will bring Cirque back ... I could never say no to Guy, because there is such a beautiful history between us." Alas... CIRQUE FILES FOR BANKRUPTCY Cirque du Soleil Entertainment Group ("Cirque du Soleil," "Cirque," or the "Company") announced [on June 29th] that it and certain of its affiliated companies have filed for protection from creditors under the Companies' Creditors Arrangement Act ("CCAA") in order to restructure its capital structure. Its application under the CCAA will be heard tomorrow by the Superior Court of Québec (Commercial Division) (the "Court"). If the Court grants the initial order sought, the Company will seek its immediate provisional recognition in the United States under Chapter 15 of the US Bankruptcy Code in the United States Bankruptcy Court. In connection with the filing, Cirque du Soleil announced that it has entered into a "stalking horse" purchase agreement ("Purchase Agreement") with its existing shareholders TPG, Fosun, and Caisse de dépôt et placement du Québec (the "Sponsors") as well as Investissement Québec as a debt provider, pursuant to which the Sponsors would acquire substantially all of the Company's assets, for a combination of cash, debt, and equity, and would establish two funds totaling US$20 million to provide additional relief to impacted employees and independent contractors. Subject to the Court's approval, the Purchase Agreement will serve as the "stalking horse" bid in a sale and investment solicitation process ("SISP") supervised by the Court and the monitor, who will be appointed by the Court. The Purchase Agreement sets the floor, or minimum acceptable bid, for an auction of the Company under the Court's supervision pursuant to the SISP, which is designed to achieve the highest value available or otherwise best offer for the Company and its stakeholders. { Read More of the Bankruptcy Announcement Here } As part of its solicitation of proposals in its sale process, the Company asked that the potential bidders to specify their intentions with regard to Cirque's terminated employees, including financial compensation for these employees, the maintaining of the operations in Quebec, and a clear path to rebuilding operations, all of which have been and will continue to be material considerations of the Company taken into account as part of the SISP. The fight, however, was far from over. BATAILLE À MORT Cirque's creditors were upset, to put it mildly, at the company's restructuring plan as announced. The lenders who held most of Cirque's nearly $1 billion million debt were not accepting a bid by the company to seek bankruptcy protection. Under Cirque's restructuring proposal, TPG Capital, China-based Fosun Capital Group and the Caisse de dépôt et placement du Québec offered to purchase and restart the company for $400 million. They would thus have a 55-percent stake in the company. In this plan, lenders would be paid pennies on the dollar for what they were owed. Furthermore, these very same lenders had, on June 8th, days before Cirque’s restructuring announcement, proposed to inject $300 million into the Cirque du Soleil under a bankruptcy restructuring plan that would also convert the company’s debt into a 100% ownership stake. They would also rehire nearly 95% of the company's payroll and maintain the company's headquarters in Montreal. The TPG proposal left those furloughed twisting in the wind. The creditors included Canada-based Catalyst Capital, as well as US investment firms Shenkman Capital, Providence Equity's Benefit Street Partners and CBAM. (The latter is controlled by Eldridge Industries, which owns more than 20 percent of the Los Angeles Dodgers, as well as Dick Clark Productions, The Hollywood Reporter, and film distributor A24.) The group thought that current Cirque management was taking the offer seriously. But instead, Lamarre and the Cirque board of directors blindsided the creditors group, filing for bankruptcy protection in Quebec Superior Court and proposed a plan that would protect the stake of the three current owners. Lamarre's deal included permanently firing 3,480 employees and using US$200 million from the Quebec government from a loan already promised by Economy Minister Pierre Fitzgibbon. "Ours is a constructive proposal focused on preserving all employees, providing more money than was presented ... and (we will be) achieving this while preserving the company in Quebec without having to use any taxpayers' money," said Gabriel de Alba, managing director at the Toronto-based private equity firm Catalyst Capital Group. In its bankruptcy filing and in his public comments in weeks prior, Lamarre had blamed all of the Cirque's financial woes on the COVID-19 pandemic, but court documents underline that there had been big financial issues for years. Net losses at the company increased from US$10 million to US$80 million between 2017 and 2019. Sources close to the creditors group said the losses began piling up shortly after Guy Laliberté sold the circus to TPG in 2015. The debt increased from around US$300 million to US$1.2 billion over those five years. "The leverage on the organization was immense, but the profitability went nowhere," a source said. "They were already in trouble (before COVID). They were already starting to stretch out their accounts payable as early as last August. They were deciding not to pay people." At the time of the restructuring announcement on June 29th, there were reportedly six bids to acquire the Cirque. Who would win out?

|

![[Back]](../images/arrow.gif)

"R.U.N" was in trouble from the very beginning. The show had received scathing

reviews since its debut, with many declaring it the "worst show ever in Las Vegas."

On TripAdvisor, 115 "terrible" ratings with just 31 "excellent" ratings, although a

good deal of the "excellent" ratings were of questionable origin. For example, many

used the same or similar terminology ("immersive!"), and were written by first-time

reviewers using generic profile photos. Another common theme among the dubious raves

were claims audience disappointment with the show was due to it not being a "typical

Cirque show." We can't disagree, as typical Cirque shows are "enjoyable" and

"entertaining" and tend to not feature torture sequences. As the future of R.U.N

grew dim, Vital Vegas reported that Cirque called in a new director to overhaul

the show (but that new director had left the project quickly), and that buzz from

insiders suggested TPG Capital, the majority owner of Cirque du Soleil, had run out

of patience and refused to invest any further in the show's $62 million concept.

Thus, R.U.N's fate was sealed and the show permanently closed on March 8, 2020.

"Many avenues of creative options were explored to enhance the existing show, but

the resources and time needed to make these changes proved to be obstacles too big

to overcome," Cirque said of the closure. It'd been said the show was losing about

$1.6 million a month.

"R.U.N" was in trouble from the very beginning. The show had received scathing

reviews since its debut, with many declaring it the "worst show ever in Las Vegas."

On TripAdvisor, 115 "terrible" ratings with just 31 "excellent" ratings, although a

good deal of the "excellent" ratings were of questionable origin. For example, many

used the same or similar terminology ("immersive!"), and were written by first-time

reviewers using generic profile photos. Another common theme among the dubious raves

were claims audience disappointment with the show was due to it not being a "typical

Cirque show." We can't disagree, as typical Cirque shows are "enjoyable" and

"entertaining" and tend to not feature torture sequences. As the future of R.U.N

grew dim, Vital Vegas reported that Cirque called in a new director to overhaul

the show (but that new director had left the project quickly), and that buzz from

insiders suggested TPG Capital, the majority owner of Cirque du Soleil, had run out

of patience and refused to invest any further in the show's $62 million concept.

Thus, R.U.N's fate was sealed and the show permanently closed on March 8, 2020.

"Many avenues of creative options were explored to enhance the existing show, but

the resources and time needed to make these changes proved to be obstacles too big

to overcome," Cirque said of the closure. It'd been said the show was losing about

$1.6 million a month.